How to Accumulate Your First Million Dollars

Hello from Sycamore,

The looming question out there for many is how do I save a million dollars? Starting off it may seem impossible, but we are here to tell you that with dedication, a strict budget, and time it is possible. It is also important to note that you do not have to make “a lot” of money for this to be possible. The earlier you start investing, the easier it will be.

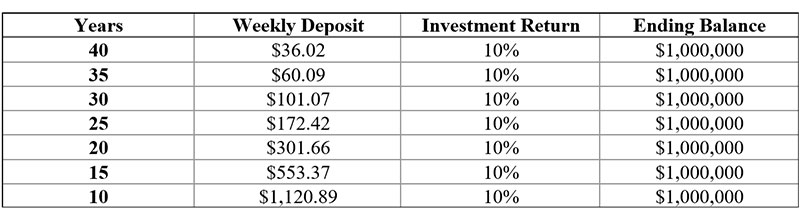

Three main factors influence how quickly this aspiration might be attained and they are investment time horizon, contribution amount, and investment rate of return. We realize that some of you reading this have already reached one million dollars of investment assets, but for those who have not, let us look at a few different scenarios to see what it takes to accumulate $1,000,000 in a portfolio.

To oversimplify, we will assume a 10% rate of return on your investment compounded weekly.

As you can see, the earlier you start the less you will need to save weekly. Other important factors will come into play and this should be discussed with a financial professional. Please feel free to call us with any questions or concerns!

As always, we would love to hear from you! Please reach out with any comments or concerns you may have.

Thank you for your business and trust,

Brent Yard

Sycamore Financial Group

*** Taxes and portfolio turnover are not accounted for in the above example. All investment strategies and investments involve the risk of loss. Actual investment returns may vary. This article is distributed for general informational and educational purposes and is not intended to constitute legal, tax, accounting, or investment advice. The information, opinions, and views contained herein have not been tailored to the investment objectives of any one individual, are only current as of the date hereof, and may be subject to change. Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional to assess where the ideas or strategies that are discussed are suitable based on your own personal financial objectives, needs, and risk tolerance. ***