Hello from Sycamore,

The ‘Saver’s Credit’ may make it possible for you to receive a tax credit on your eligible contributions to your IRA or employer-sponsored retirement plan. Depending on your adjusted gross income, you may be eligible to receive a tax credit of up to 50% on the first $2,000 of contributions you make to a qualified retirement plan or IRA. These savings are in addition to any tax deferral that may be available on the contribution.

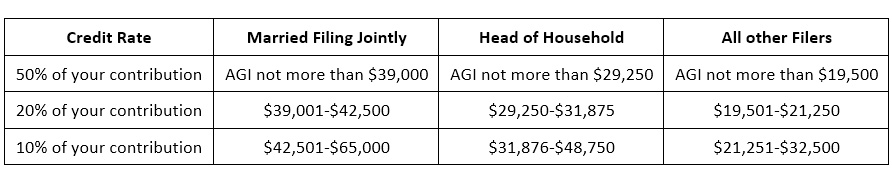

Limitations do apply – you must be 18 or older, cannot be a full-time student and may not be claimed as a dependent on anyone’s tax returns. The table below help you understand if you might qualify.

What does this really mean?

If you are married filing jointly and your adjusted gross income is $50,000 you could receive up to 10% tax credit on the first $2,000 you contribute to your retirement accounts. $2,000 x 10% = $200 tax credit.

If you are single with an adjusted gross income of $20,000 you could receive up to 20% back on the first $2,000 you contribute. $2000 x 20% = $400 tax credit.

If you fall into one of these categories, what should you do?

- Maximize your contributions to your IRA or retirement plans.

- Increase your contribution to maximize your credit.

- Bring this piece of paper to your tax preparer.

- Call Sycamore for more information or with questions.

Thanks for your business and trust!

Sycamore Financial Group

*Past performance does not assure future results. Investors cannot invest directly in the stock market indexes such as the S&P 500. Investment return and principal value of an investment will fluctuate. Investor value, when sold may be worth more or less than their original cost.