Growth and Income Portfolio Equity Composite

Investment Advisory Information

Form ADV: Part 2 A&B Click Here.

Experienced Professionals |

|

Investing for the Future |

Performance with Risk Awareness |

|

Consistency and Transparency |

|

Past performance does not assure future results. Investors cannot invest directly in the stock market indexes

such as the S&P 500. Investment return and principal value of an investment will fluctuate. Investor value,

when sold may be worth more or less than their original cost.

Separate Account Supplemental Information

Performance – The performance data given represents past performance and should not be considered indicative of future results. General market conditions and or economic conditions can have a significant impact on the performance of this composite or your individual investment. The principal value and investment return will fluctuate, so that an investor’s shares when redeemed may be worth more or less than the original investment. The separate account is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution.

Our separate account performance data is reported as a “composite” of similarly managed portfolios. As such, investors in the same separate account may have slightly different portfolio holdings because each investor has customized account needs, tax considerations, and security preferences. These performance results contain portfolios that reinvest dividends and interest as well as portfolios that withdraw all or a portion of this income.

Index Comparison – We have compared our composite performance to the S&P500 index. This index contains 500 widely held stocks and is often used as a proxy for the stock market. Your portfolio may fluctuate more or less than this index. An investor cannot invest directly in an index.

Risk – Diversification does not assure a profit and will not necessarily protect against loss in a declining market.

Definitions

Alpha: Alpha measures the difference between a separate account’s actual returns and its expected performance, given its level of risk (as measured by beta). Alpha is often seen as a measure of the value added or subtracted by a portfolio manager.

Beta: Beta is a measure of a separate account’s sensitivity to market movements. A portfolio with a beta greater than 1 is more volatile than the market, and a portfolio with a beta less than 1 is less volatile than the market.

Up-Market Capture Ratio: The up-market capture ratio is a measure of a manager’s performance in up markets relative to the index during the same period. A ratio value of 115 indicates that the manager has outperformed the market index by 15% in periods when the index has risen

Down-Market Capture Ratio: This ratio is the direct opposite of the up-market capture ratio, gauging the performance of the manager relative to the index in down markets. A ratio value of 80 would indicate the manager has declined only 80% as much as the declining overall market, indicating relative outperformance.

Disclosure – © 2025 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5

Stars: the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating™ for a fund is derived from a weighted average of the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar Rating™ metrics. Sycamore Growth and Income Equity was rated against the following numbers of U.S.-domiciled Large Blend Category funds over the following time periods: 744 funds in the last three years, 667 funds in the last five years, and 491 funds in the last ten years. With respect to these Large Blend Category funds, Sycamore Growth and Income Composite received a Morningstar Rating™ of 2 stars, 2 stars, and 3 stars for the three-, five-, and ten-year periods, respectively.

Past performance is no guarantee of future results.

© 2025 Sycamore Financial Group. All other trademarks are the exclusive property of their respective companies.

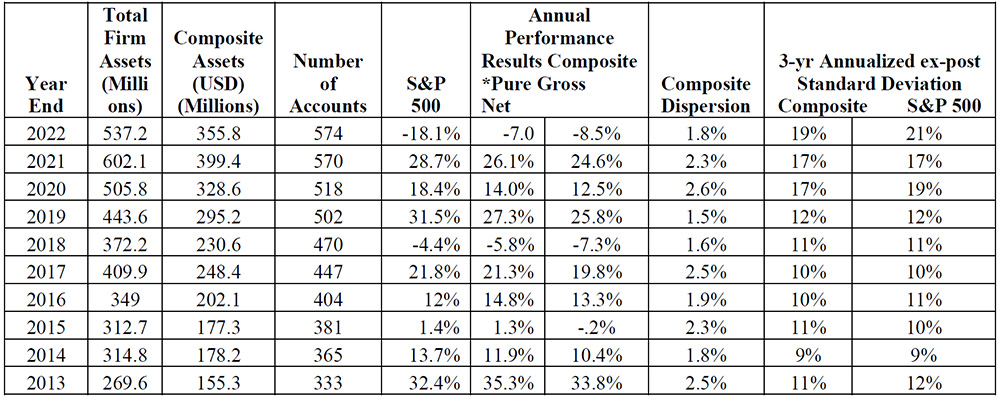

Growth and Income Composite Annual Disclosure Presentation

TWR (Time-Weighted Return) for Selected Periods Gross of Fees

December 31, 2022

Year to Date | Latest 1 Year | Annualized Latest 3 Years | Annualized Latest 5 Years | Annualized Last 10 Years | Annualized Last 15 Years | Annualized Last 20 Years | |

Account | -6.99 | -6.99 | 8.23 | 8.32 | 10.63 | 8.15 | 9.05 |

S&P 500 Return | -16.62 | -16.62 | 5.32 | 7.31 | 9.79 | 7.50 | 8.31 |

“N.A. – Not applicable”

*Pure Gross returns are shown as supplemental information. See below for additional important disclosures.

Sycamore Growth and Income Composite contains only fully discretionary growth and income equity accounts that invest in securities on the Sycamore approved trading list, (which consist only of common and preferred stocks) and for comparison purposes is measured against the S&P 500 Index. The minimum account value for inclusion in the composite is $100,000, as of October 1, 2013, If for any reason a portfolio falls below $60,000 for 2 consecutive quarters it will be removed from the composite.

Sycamore Financial Group claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Sycamore Financial Group has been independently verified for the periods September 30, 1996 through December 31, 2022. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Sycamore Growth and Income Composite has had a performance examination for the periods September 30, 1996 through December 31, 2022. The verification and performance examination reports are available upon request.

Verification assesses whether (1) the firm has complied with all the composite construction requirements of the GIPS standards on a firm-wide basis and (2) the firm’s policies and procedures are designed to calculate and present performance in compliance with the GIPS standards.

Sycamore Financial Group is an independent registered investment adviser. The firm maintains a complete list of composite descriptions, which is available upon request.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Returns include the effect of foreign currency exchange rates. Composite performance is presented gross of foreign withholding taxes on dividends, interest income, and capital gains. Withholding taxes may vary according to the investor’s domicile. Composite returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results.

The U.S. Dollar is the currency used to express performance. Returns are presented gross and net of management fees and custodial fees and include the reinvestment of all income. Both gross and net returns are reduced by trading expenses for accounts that pay commissions on trades. Beginning in 2015, certain accounts pay an asset-based fee to their custodian that includes all trading expenses. This results in a “pure gross” return for these accounts as only net of fees returns are reduced by this asset-based fee. Pure gross returns are shown as supplemental information to net of fee returns. Net of fee performance was calculated using a model fee. Model net returns are calculated by applying a model fee of 1.5% at the composite level annually. The model fee is the highest tier of the investment management fee in effect for this composite. The annual composite dispersion presented is an asset-weighted standard deviation calculated for the accounts in the composite the entire year. Additional information regarding policies for valuing investments, calculating performance, and preparing GIPS reports are available upon request.

The composite dispersion and 3yr annualized standard deviation are calculated using gross returns.

The investment management fee schedule for the composite is 1.5% on the first $0.5million, 1% on the next $1 million, 0.8% on the next $8.5 million, and .6% on amounts above $10 million. Actual investment advisory fees incurred by clients may vary.

The Sycamore Growth and Income Composite was created, September 30, 1996. Inception date is also Sept. 30, 1996.

Separate Account Supplemental Information

Performance – The performance data given represents past performance and should not be considered indicative of future results. General market conditions and or economic conditions can have a significant impact on the performance of this composite or your individual investment. The principal value and investment return will fluctuate, so that an investor’s shares when redeemed may be worth more or less than the original investment. The separate account is not FDIC-insured, may lose value, and is not guaranteed by a bank or other financial institution.

Our separate account performance data is reported as a “composite” of similarly managed portfolios. As such, investors in the same separate account may have slightly different portfolio holdings because each investor has customized account needs, tax considerations, and security preferences.

These performance results contain portfolios that reinvest dividends and interest as well as portfolios that withdraw all or a portion of this income.

Index Comparison – We have compared our composite performance to the S&P500 index. This index contains 500 widely held stocks and is often used as a proxy for the stock market. Your portfolio may fluctuate more or less than this index.

An investor cannot invest directly in an index.

Composite Dispersion – This is a measure of the variation of individual account performance within our composite. Your portfolio may perform better or worse than our composite and while there is no guarantee of future performance, the composite dispersion gives you guidance on the amount of overperformance or underperformance that you may expect during most periods.

© 2025 Sycamore Financial Group. All other trademarks are the exclusive property of their respective companies.